lucky calico online casino login philippines

ROME (AP) — Robert Lewandowski joined Cristiano Ronaldo and Lionel Messi as the only players in Champions League history with 100 or more goals. But Erling Haaland is on a faster pace than anyone by boosting his total to 46 goals at age 24 on Tuesday. Still, Haaland's brace wasn't enough for Manchester City in a 3-3 draw with Feyenoord that extended the Premier League champion's winless streak to six matches. Lewandowski’s early penalty kick started Barcelona off to a 3-0 win over previously unbeaten Brest to move into second place in the new single-league format. The Poland striker added goal No. 101 in second-half stoppage time. Ronaldo leads the all-time scoring list with 140 goals and Messi is next with 129. But neither Ronaldo nor Messi play in the Champions League anymore following moves to Saudi Arabia and the United States, respectively. The 36-year-old Lewandowski required 125 matches to reach the century mark, two more than Messi (123) and 12 fewer than Ronaldo (137). Barcelona also got a second-half score from Dani Olmo. The top eight finishers in the standings advance directly to the round of 16 in March. Teams ranked ninth to 24th go into a knockout playoffs round in February, while the bottom 12 teams are eliminated. Haaland has 46 goals in 44 games Haaland converted a first-half penalty to eclipse Messi as the youngest player to reach 45 goals then scored City's third after the break to raise his total to 46 goals in 44 games. Ilkay Gundogan had City's second. But then Feyenoord struck back with goals from Anis Hadj Moussa, Santiago Gimenez and David Hancko. Inter leads standings and hasn't conceded a goal Inter Milan beat Leipzig 1-0 with an own goal to move atop the standings with 13 points, one more than Barcelona and Liverpool, which faces Real Madrid on Wednesday. The Serie A champion is the only club that hasn't conceded a goal. Bayern Munich beat Paris Saint-Germain 1-0 — the same score from the 2020 final between the two teams. PSG ended with 10 men and remained in the elimination zone. The French powerhouse has struggled in Europe after Kylian Mbappe’s move to Real Madrid. Atalanta moved within two points of the lead with a 6-1 win at Young Boys. Also, Arsenal won 5-1 at Sporting Lisbon; and Bayer Leverkusen routed Salzburg 5-0. AC Milan follows up win over Real Madrid with another victory AC Milan followed up its win at Real Madrid with a 3-2 victory at last-place Slovan Bratislava in an early match. Christian Pulisic put the seven-time champion ahead midway through the first half by finishing off a counterattack. Then Rafael Leao restored the Rossoneri’s advantage after Tigran Barseghyan had equalized for Bratislava and Tammy Abraham quickly added another. Nino Marcelli scored with a long-range strike in the 88th for Bratislava, which ended with 10 men. Bratislava has lost all five of its matches. Alvarez and Griezmann lead Atletico to 6-0 rout Argentina World Cup winner Julian Alvarez scored twice and Atletico Madrid routed Sparta Prague 6-0 in the other early game. Alvarez scored with a free kick 15 minutes in and Marcos Llorente added a long-range strike before the break. Alvarez finished off a counterattack early in the second half after being set up by substitute Antoine Griezmann, who then marked his 100th Champions League game by getting on the scoresheet himself. Angel Correa added a late brace for Atletico, which earned its biggest away win in Europe. Atletico beat Paris Saint-Germain in the previous round and extended its winning streak across all competitions to six matches. ___ AP soccer: https://apnews.com/hub/soccer Andrew Dampf, The Associated PressShopping on Shein and Temu for holiday gifts? You're not the only oneLSU’s Bowl Game matchup has been announced

PIL donates MK7.8 million solar water pump to Malomo Health CentreAmericans made $3.6 billion in charitable donations this week — a double-digit increase of 16% from Giving Tuesday 2023’s total of $3.1 billion, according to The GivingTuesday Data Commons , the group that tracks the data. And more people than ever — 36.1 million — donated to a charity that day, up 7% from last year. Add this to the mix: Giving by individuals is predicted to increase by 2.6% in 2024 and by 3.4% in 2025, surpassing previous annual average giving bumps, according to research from the Indiana University Lilly Family School of Philanthropy. That feels good. As we slide into December, many of us who bypassed the much-hyped Giving Tuesday, me included, are focusing on making charitable contributions by year-end to reduce taxes or simply revel in that holiday spirit of giving. For me, and I suspect lots of you, giving is really more about your heart than a tax strategy. People have similar motivations for giving, according to Fidelity Charitable’s research : making a difference, giving back to their community, and faith are aspects of financial giving donors find most rewarding. For Shannon Bonney, 26, that’s the case. Last year, she became a member of Many Hands , a nonprofit philanthropic “giving circle” with a membership of around 275 women. The collective giving organization supports nonprofits in the Washington, D.C., area focused on women, children, and families in socioeconomic need. Members under 35 make an annual gift of $300. Older donors contribute a minimum annual gift of $1,000. Donating through a giving circle , where individuals, often women, pool their funds and their decision-making to make grants, is the hottest trend in philanthropy. Per a report from Philanthropy Together, the number of giving circles and the number of people who are part of one tripled between 2007 and 2016 — and then tripled again between 2016 and 2023. There are now more than 4,000 giving circles across the country with 370,000 members. Among them, they gave away more than $3 billion over a five-year period ending in 2023. “I chose a giving circle because it’s the most effective way to pool money with people and then get that in a lump sum to the organization,” Bonney said. “It’s a lot more impactful to have your money be part of tens of thousands of dollars that are going to that group.” The amount of giving per member varies by giving circle. Some circles set a lower giving level that can range from $200 to $500 annually. Others opt to set it higher, say, $5,000 to $25,000 a year. (The Giving Compass site has a Giving Circle search tool to find ones near you focused on missions of interest). Read more: Wondering what to do with your tax refund? 5 ways to spend it wisely Most of us don’t know much about nitty-gritty tax strategies that could make our donations more financially impactful. To write off donations, your total tax deductions need to exceed the standard deduction to be worthwhile. For 2024, the standard deduction is $14,600 for single filers and $29,200 for married couples filing jointly. The tax deduction is a lure for most Americans, with retirees marginally less likely than others to say it’s important to their giving decision. One way to exceed that standard deduction threshold is to bunch together your contributions and give two years' worth of deductions in one year, so your total giving will be high enough to allow you to itemize. “This can be extremely effective for gifting in years of higher-than-normal income — for example, if you sold a business or real estate, received a large bonus payout, exercised stock options, or sold and diversified a concentrated low-basis stock position,” Brandon O’Neill, a certified financial planner and charitable planning consultant at Fidelity Charitable, told Yahoo Finance. Another tax-saving strategy is making a charitable donation of stocks, ETFs, or mutual funds you've held for more than a year. This is a way to avoid owing capital gains taxes on their profits. You might also consider a donor-advised fund (DAF), which is available from financial services firms like Fidelity, Schwab, and Vanguard. There could be minimum amounts to open an account and to give to an individual charity along with annual administrative fees. When you make a contribution of cash, stocks, mutual funds, or ETFs to a DAF, you immediately receive a tax deduction, provided you itemize. You can then invest the money for growth that is tax-free until you choose which charities you want to donate to. These funds are going mainstream but are still under-the-radar for many Americans. “A DAF is a simple, tax-effective way to dedicate money to charitable giving,” O’Neill said. “You can think about DAFs almost like a 529 or IRA for charitable giving because they allow you to strategize your giving.” Read more: Is GoFundMe tax deductible? What donors and beneficiaries should know. If you’re aged 701⁄2 or older, a qualified charitable distribution from an Individual Retirement Account (IRA) is another consideration. You make this distribution directly to a charity, reducing the amount of your taxable IRA that is subject to Required Minimum Distributions starting at age 73. You can't deduct the qualified charitable distribution, but the money won't be considered taxable income to you. Have a question about retirement? Personal finances? Anything career-related? Click here to drop Kerry Hannon a note. “The year-end retirement account balance is key to retirees because their required minimum distribution is based on that balance,” Ed Slott, a certified public accountant in New York and an expert on IRAs, previously told Yahoo Finance. “Your RMD is your best asset to give to charity.” This year you can donate up to $105,000 total to one or more charities directly from a taxable IRA. “You are getting it out at zero tax and giving it to a charity, something you would've done anyway,” Slott said. “Plus, if you do it correctly, with the timing of it, it can offset your RMD.” Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist, and the author of 14 books, including " In Control at 50+: How to Succeed in The New World of Work" and "Never Too Old To Get Rich." Follow her on Bluesky: Click here for the latest personal finance news to help you with investing, paying off debt, buying a home, retirement, and more Read the latest financial and business news from Yahoo Finance

NoneIndigenous winemakers pouring culture into every drop

Former Texas Coach Mack Brown Fired by North Carolina on Tuesday

Carlo Ancelotti plays down Jude Bellingham injury concern but Ferland Mendy suffers setbackIs Austin Ekeler OK At Hospital After Dallas Cowboys Scary Hit?Alabama left out of playoff as committee rewards SMU's wins over Crimson Tide's strong schedule

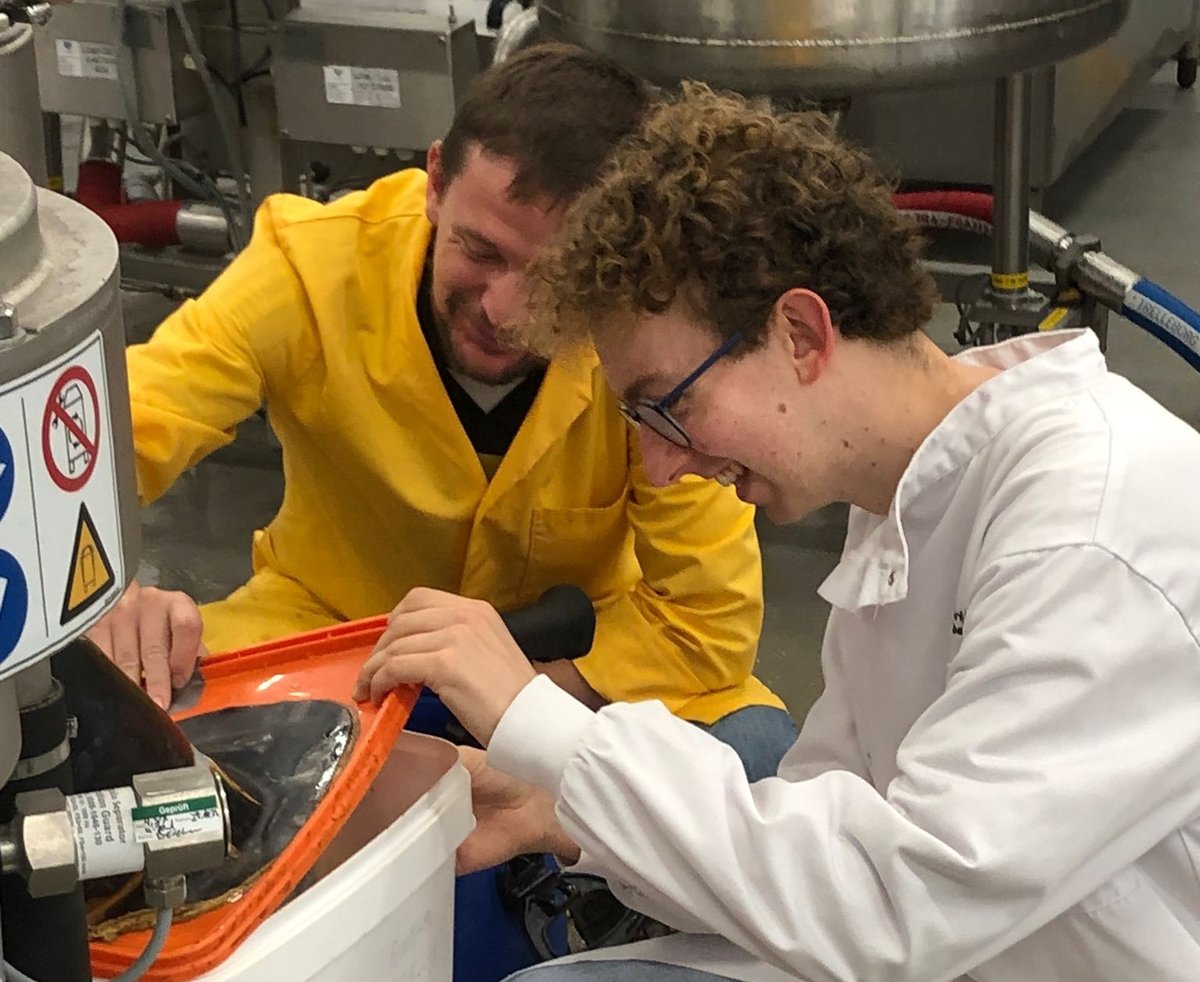

Our high sports photos, like the ones above, put you in the middle of the action. Check them out by clicking anywhere in the collage to open the photo gallery. Don’t forget to share the gallery with friends and family. These photos are available for purchase in a variety of sizes and finishes – click the blue “GET PHOTO” link below any photo to see available options and make a purchase. Lehighvalleylive.com subscribers can also get free print-quality digital downloads of any image. Note : We are trying to make these galleries available as quickly as possible. The gallery may not be in its final form. If you only see a few photos, you are likely seeing an early version and more images will be added later. Please return and refresh the page to see additions. RECOMMENDED • lehighvalleylive .com Walmart just slashed $1,000 off this massive 75′′ Sony TV in an unreal Cyber Monday deal Dec. 1, 2024, 5:45 p.m. How to watch Phillipsburg football play for its first group championship Dec. 3, 2024, 2:45 p.m. Mobile users : For the best experience downloading high-resolution images (free and available to subscribers only) or making photo purchases, visit this page from a desktop or laptop computer. The lehighvalleylive.com high school sports newsletter is appearing in mailboxes weekly. Sign up now ! Follow us on social: Facebook | X (formerly Twitter) | InstagramBraves surprisingly could be a top landing spot for 23-year-old phenom | Sporting News